In 2020, the best way ahead for companies is by creating seamless omnichannel experiences for purchasers, particularly for industries like Fintech the place making a mobile-first strategy is important. In line with a survey of banks throughout Europe, North America, and Asia-Pacific, 80% of all buyer touchpoints happen on digital.

Content

- How TitleMax is Building a Successful Omnichannel Presence

- buy keyword installs android

- buy android reviews

- google play short description aso

TitleMax is one legacy monetary model that has efficiently adopted an omnichannel technique. TitleMax, which is the flagship model of the TMX Household of Firms, was based in 1998 within the US and has expanded into 16 states. TitleMax provides title-secured loans/pawns, private loans, and features of credit score to assist as many individuals as attainable get the money they want.

Desperate to find out about their omnichannel evolution, we spoke with Adrianna Warnell, Direct Advertising Supervisor. Her function entails speaking with customers by way of numerous channels to convey them to TitleMax.

The Want for a Single Supply of Fact

When making the omnichannel transition, TitleMax had a number of touchpoints for every of their communications channels corresponding to emails, SMS, push notifications, and extra. Due to this, there have been a number of information factors to research and enormous quantities of knowledge to switch. To not point out information silos made it obscure how prospects interacted with the model. They couldn’t map the end-to-end consumer journey or make data-driven selections, which proved the necessity for an built-in platform to eradicate information silos and automate their communication.

Actionable analytics helps Warnell’s crew perceive consumer habits, together with how customers navigate the app and behave over time. Geared up with a centralized, real-time view of customers throughout information sources, they will gauge the impression of their messaging and campaigns they usually higher their advertising efforts to realize core enterprise objectives.

Educating, Participating, and Changing Customers

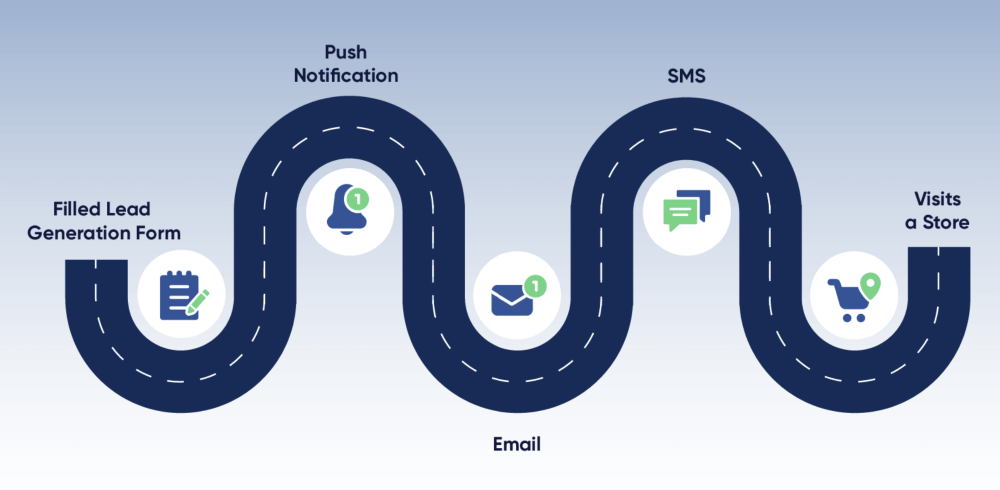

The TitleMax crew tracks KPIs like open charges, engagement charges, and conversion charges, and have created over 10 journeys to cowl their whole buyer lifecycle. For instance, they’ve a 30-day lead-nurturing journey designed to have interaction customers who’ve submitted a lead kind on their web site however haven’t but visited a retailer.

They’ve additionally arrange a cart abandonment journey that engages customers who’ve began a mortgage utility however fail to finish it. By reminding customers that their utility will expire in a few days, TitleMax will get them to finish their utility. This journey additionally provides TitleMax a possibility to cross-sell merchandise.

Reaching Customers on the Greatest Time

TitleMax communicates with prospects on a wide range of channels, together with e mail, textual content, junk mail, push notifications, app pop-ups, internet pop-ups, and the app inbox. TitleMax makes use of the finest time for batch marketing campaign characteristic to have interaction with prospects at their most popular time and create a greater buyer expertise.

They monitor any points with e mail bounces by staggering campaigns. If needed, they will pause between campaigns to troubleshoot underlying points. With these ways, Warnell’s crew achieves an open charge of as much as 70%. And by automating routine duties, she will be able to focus extra on advertising technique.

Adapting to the Evolving Instances

In the course of the starting of COVID-19, Warnell obtained requests to ship numerous forms of communications, starting from retailer closures to broadcasting letters, from their President. The crew has seen a dramatic enhance in its cellular adoption charge for the reason that begin of COVID-19.

Participating with customers by way of numerous channels will stay a high precedence for TitleMax whereas transferring ahead with a mobile-first enterprise mannequin. We’re proud to companion with TitleMax of their journey to make credit score accessible to everybody.