In the case of banking and monetary companies, Fintech has lengthy been lauded as a disruptor — a know-how that is available in and destabilizes the prevailing infrastructure for higher or worse. However what occurs when different elements come into play to disrupt the disruptor?

Content

- 3 Factors Disrupting Fintech

- guaranteed android ranking

- among us success story

- dating apps case study

Beneath, we cowl three issues which are set to disrupt the Fintech house, notably within the US. And what it would imply on your Fintech app and model.

How Fintech Disrupted Monetary Companies

Again in 2016, with Fintech starting to alter how monetary companies have been being delivered, Deloitte listed 5 key takeaways that monetary executives needed to take into account. These takeaways outlined how Fintech was going to be affecting incumbent corporations. They famous how:

- Higher personalization in retail monetary companies merchandise would break the grip of standardized

merchandise. - New markets would open up, providing alternatives to develop new and extra worthwhile audiences.

- Incumbents would use on-line social norms and platforms to get extra full management over elements of the monetary provide chain, from resolution help to monetary intermediation.

- The enjoying subject would stage out as massive and small companies took benefit of rising networks and platform-based companies to decrease value, enhance compliance, and give attention to markets the place they’ve true aggressive benefit.

- New sources of knowledge would emerge and each AI and analytics would develop extra superior, however that the contribution of actual people would develop into extra necessary than ever.

For probably the most half, these elements ended up coming true, resulting in a extra widespread acceptance of the know-how, which the present pandemic has solely accelerated on a world scale.

In a current submit, The New Guidelines of Fintech, Hernando Rubio, the CEO of Fintech startup MOVii, had this to say in regards to the disruption as revolution:

“Banks have been providing companies for a whole bunch of years, however since they’ve been utilizing outdated know-how and have a really costly value construction, their enterprise mannequin is outlined primarily based on charging charges. And solely 20% of the viewers can afford these charges. The opposite 80% are who the Fintech revolution is for.”

3 Elements That Could Disrupt Fintech within the US

However with the present state of occasions, there are three elements which can but disrupt the Fintech business because it now stands.

1. Large Manufacturers Are Competing With Startups

Many Fintech startups discovered success by appearing rapidly, innovating on merchandise that their prospects wanted, and supplying reasonably priced monetary companies supported by cutting-edge digital instruments. Immediately, small startups may present unbanked folks in creating nations with the power to pay their payments on-line, and be part of a world of contactless transactions and digital funds.

However the incumbent monetary establishments haven’t simply been taking notes, they’ve been investing in — and shopping for up — Fintech startups, ultimately folding the brand new know-how into their tech stacks and product portfolios.

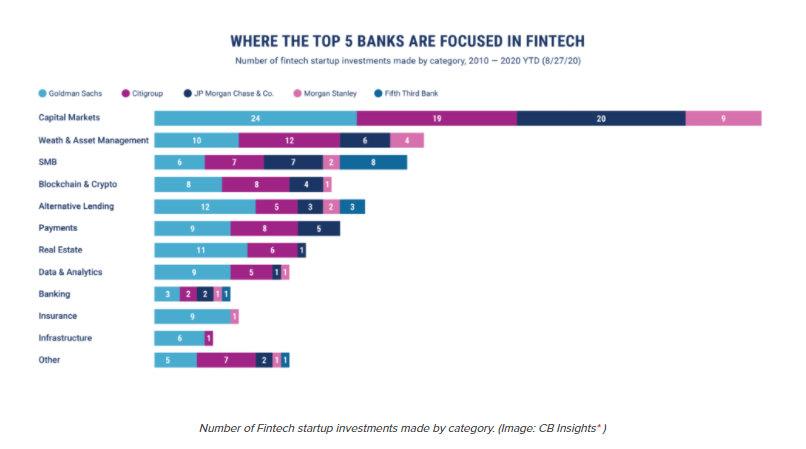

From 2018 to 2020, Goldman Sachs and Citigroup participated in 59 and 38 Fintech offers respectively. In that very same time span, JP Morgan invested in 10 corporations in capital markets and 5 in SMB options. In the meantime, different US banks like Morgan Stanley, Fifth Third Financial institution, Financial institution of America, Capital One, and Wells Fargo backed a minimum of 10 Fintech offers since 2012.

What may the repercussions be for Fintech apps?

These extra conventional incumbent companies benefit from scale and expertise. Their massive buyer base offers them with way more actionable knowledge and their investments into Fintech give them the instruments to attain the pace of startups. Which suggests the primary mover benefit of Fintech is probably not sufficient to maintain startups afloat if and when these incumbents determine to go after the identical markets.

2. Blockchain Is the New Gold Rush

Yearly we learn that blockchain know-how is on the verge of turning into as mainstream as, say, Fb. In any case, when grandparents begin utilizing a digital instrument, that solely means it’s reached peak adoption.

And blockchain is getting there, with manufacturers like Microsoft, AT&T, Dwelling Depot, Complete Meals, and most lately, Paypal and Sq. permitting cost utilizing bitcoin and digital currencies. One thing that might have been extraordinary a mere 2 years again, when bitcoin was being hailed as a rip-off and a bubble that might quickly burst.

As of late, an increasing number of huge companies are throwing cash behind blockchain, making an attempt to be first movers in a mad rush to launch the killer software for it.

However how does this disrupt the present state of Fintech?

The truth that blockchain is a decentralized instrument with nobody single repository for person knowledge is a big consider giving Monetary know-how an edge. The decentralization will help mitigate fraud and bolster cybersecurity for Fintech companies, maintaining knowledge from being altered whilst it’s shared between completely different monetary service suppliers.

This safety permits blockchain to not solely help digital funds but additionally good contracts, share buying and selling between customers, and set up a person’s digital identification.

Positive, it’s nonetheless in a development section and its full potential has but to be reached, however like different rising applied sciences, blockchain needs to be monitored and explored as its eventual utility may give your Fintech enterprise the benefit it wants.

3. The Incoming Biden Administration is Supportive

The pandemic accelerated the utilization of Fintech companies, bringing a couple of essential mass of individuals making use of on-line banking or digital funds — some for the primary time. However, like something that achieves large recognition, a battleground seems between supporting new improvements and controlling the older infrastructures that it seeks to disrupt.

Fortunately, the outlook seems constructive for the approaching yr.

Simply final January 2020, there have been already 108 payments within the US Congress that instantly impacted Fintech, with 56% % of them capturing bipartisan help – a vital issue for getting something permitted. These payments ran the gamut from supporting extra stringent regulation to enhancing the business’s supervisory features to enhancing the ways in which small companies may elevate capital. Moreover, there have been 199 different payments that not directly impacted Fintech.

And with the Biden administration being supportive of the Fintech business, it’s anticipated to be a high precedence. In response to Isaac Boltansky, director of coverage analysis for Compass Level Analysis and Buying and selling, monetary companies points will fall instantly behind the pandemic, well being care and the atmosphere as high priorities for the brand new administration.

In an interview, Boltansky stated: “The truth that we’re nonetheless speaking about sending folks checks in 2020 needs to be deeply irritating to everybody concerned. So I believe there shall be a willingness, if not an eagerness, to look at the monetary structure. That gives a possibility for Fintechs.”

The Brilliant Way forward for Fintech

Nonetheless the longer term might play out, the actual fact stays that Fintech apps are integral to the graceful working of a post-COVID world the place contactless transactions are a necessity. And these three elements, although they could spell out new issues for the monetary know-how business, are nonetheless secondary to the first problem of each Fintech app: delivering a customized, pleasant expertise that makes life simpler for each buyer.